Membership Information

Want to learn more about APP Membership? You have come to the right place!

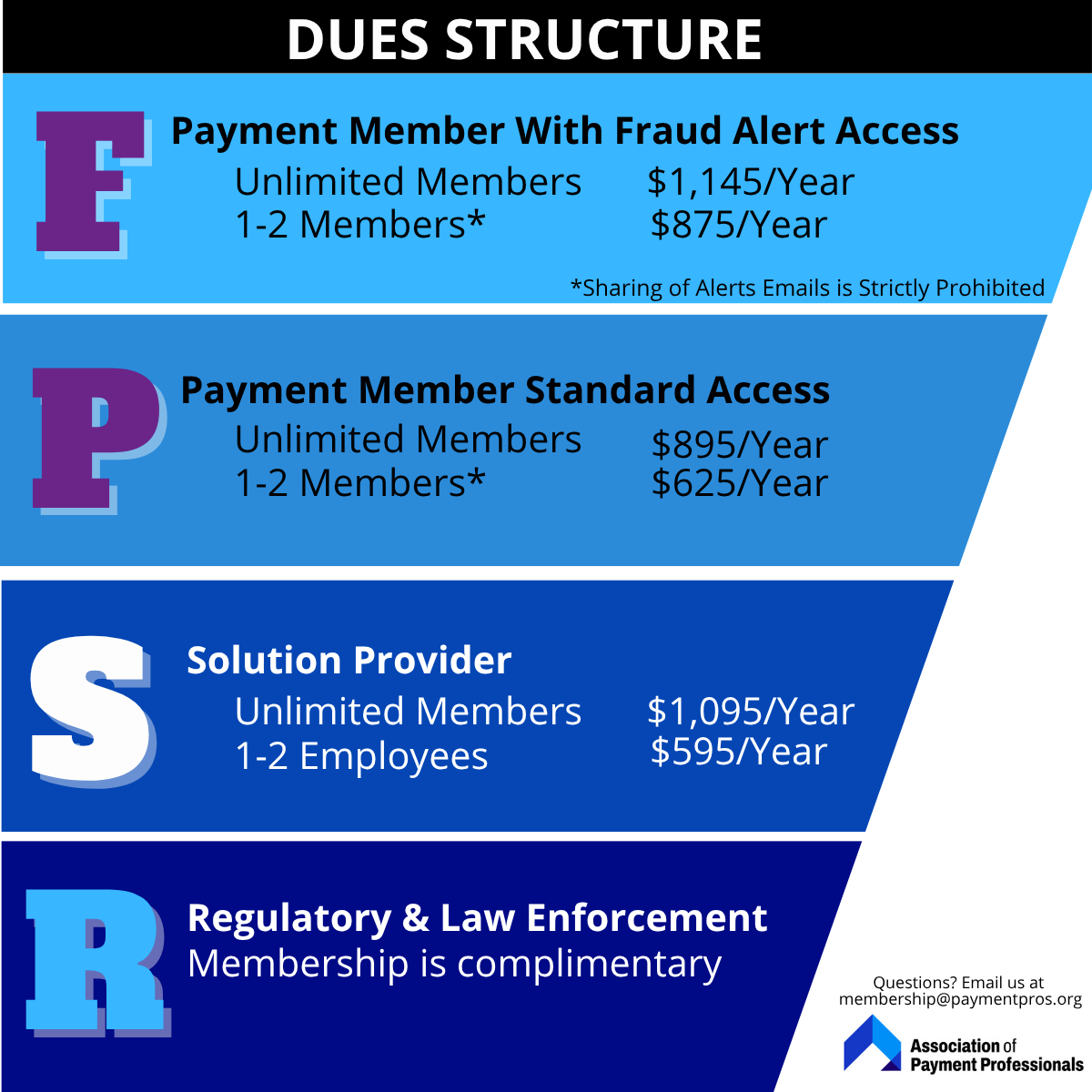

All membership applications are reviewed by volunteers on the Membership Committee. Most applications are reviewed within business days, but additional delays may occur during some parts of the year. Applicants receive limited member benefits while the Committee conducts its review. New Members - Dues rates posted are effective for new members as of 6/1/25. The APP Board approved maintaining dues at these rates until 5/30/2025. Current Members -Dues rates posted will be in effect starting 6/1/25. Any one with a renewal date before 9/1/24 will pay the previous rates. Fraud Alerts & Membership Level Please select the category of membership that best matches your organization type. If you have any questions on which category of membership would be the right fit or other membership questions, please contact us, and one of our awesome volunteers or a staff member will be happy to assist you!

APP offers four distinct categories of membership. Each category is unique.

All payment members qualify for standard access.

Additional approval is required for "Enhanced Membership" which comes with Fraud Alerts access.

One of the most used member benefits is the Alerts system colloquially this group us referred to as the "Fraud Alerts". There are four types of restricted Alerts including: Merchant Information Request, Fraud Alert, MATCH, and Agent/ISO Inquiry. Because of the nature of the Alerts, only those members who are vetted and approved are qualified for that membership type. The type of portfolio you have will determine eligibility such as risk level and current sponsor bank oversight. Restricted alerts are granted by the Membership Committee based on criteria defined by the Board. They are primarily determined based on a combination of job role and organization type.

Payment Member

Businesses offering direct or indirect access to payment processing functionality, including ACH capabilities. This category can include but is not limited to acquirers, ISO & MSPs, payment facilitators, MSBs, or bill payment organizations.

Access to Restricted Alerts (i.e. Fraud Alerts) requires approval (based on portfolio) and is at an elevated dues rate.

Solution Partner

Regulatory & Law Enforcement

Applies to all the major card brands, PCI SSC, and Nacha. It includes regulatory enforcement agencies, agencies that protect consumers from unfair and abusive practices, and law enforcement. It also includes staff from partner associations with aligned missions, such as Paytech Women and ETA. Active academics and researchers investigating payment technologies to address payment risk, fraud prevention, and related topics are invited to join this category.